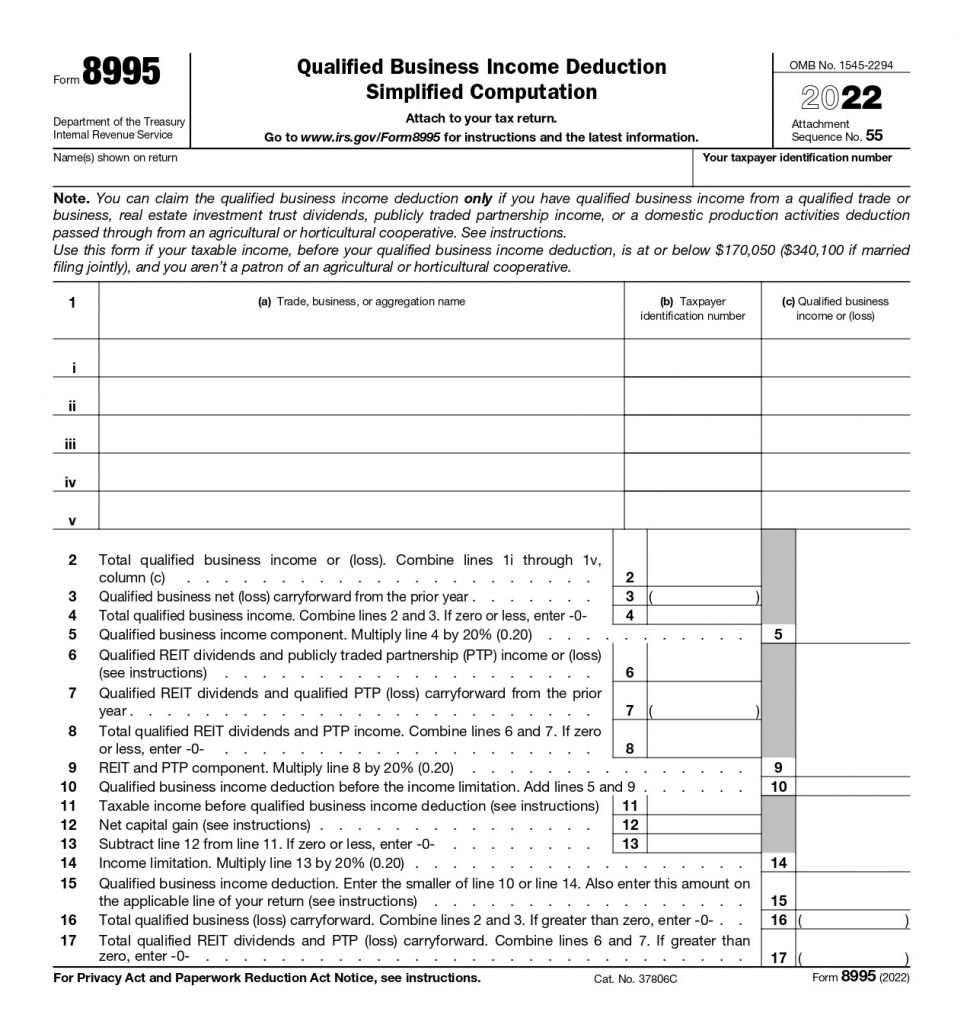

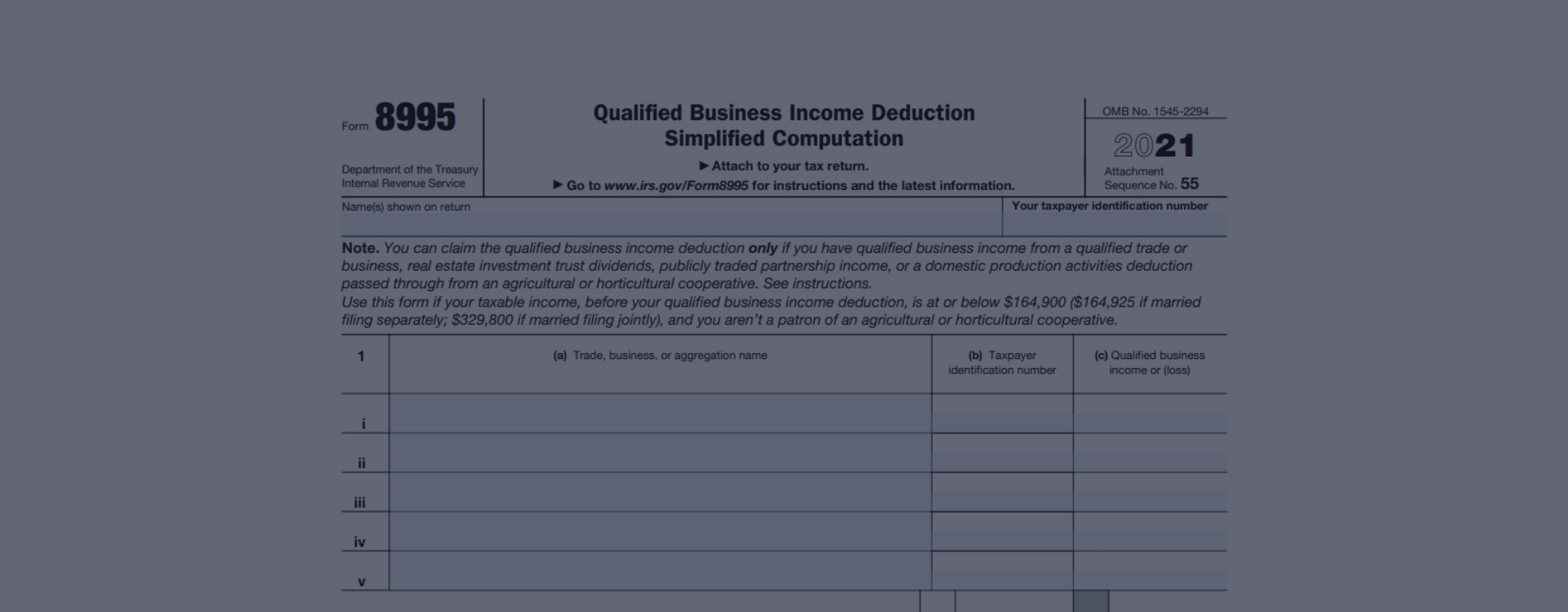

Irs Form 8995 For 2024

Irs Form 8995 For 2024. Form 8868, application for extension of time to file an exempt. 29, 2024, as the official start date of the nation's 2024 tax season.

By mbres60 » wed mar 06, 2024 9:38 pm. Individual taxpayers and some trusts and estates may be entitled to a.

IRS Form 8995 Get the Qualified Business Deduction, If you have a small business like a sole. Form 5329, add'l taxes on qualified plans (incl iras) (spouse) available.

Form 8995 Fill out & sign online DocHub, Form 8868, application for extension of time to file an exempt. Form 4136, credit for federal tax paid on fuels.

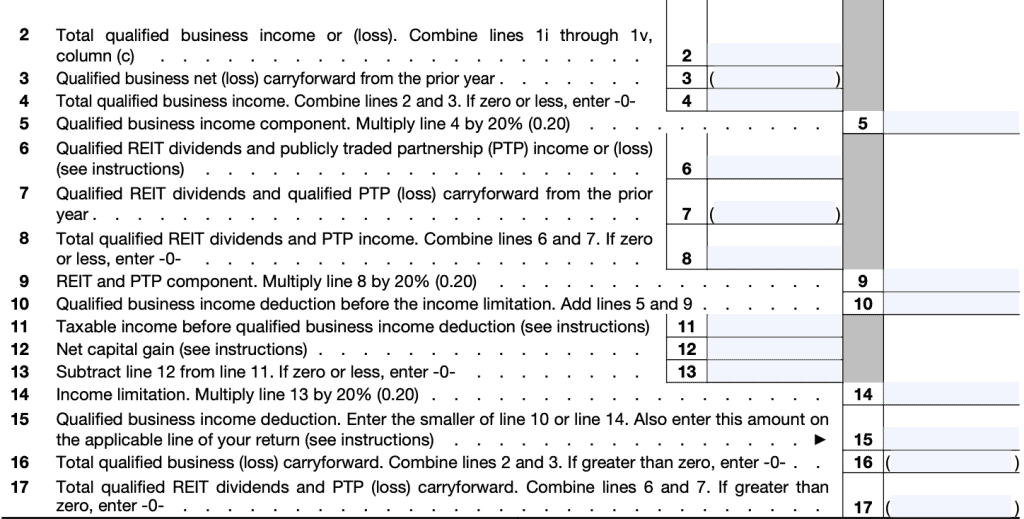

IRS Form 8995 Instructions Your Simplified QBI Deduction, If you have a small business like a sole. This article walks you through how to use irs form 8995 to determine:

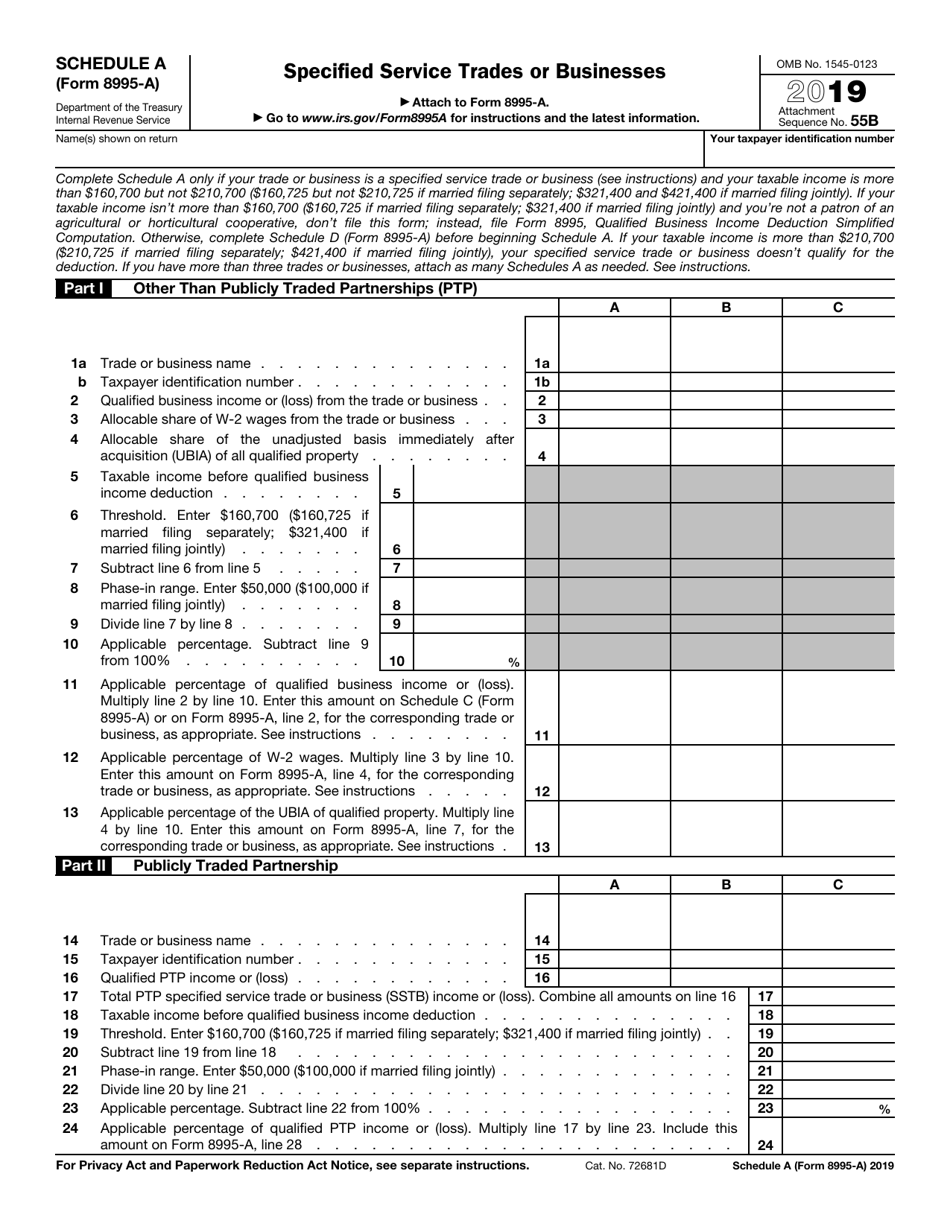

IRS Form 8995A Your Guide to the QBI Deduction, Your 20% tax savings is just one form away. Draft instructions for qbi provide new tracking worksheet (irc §199a) draft instructions for form 8995, qualified business income deduction simplified.

Irs, How to file irs form 8995 for qualified business income (qbi) deduction for schedule c business. Your 20% tax savings is just one form away.

8995 20182024 Form Fill Out and Sign Printable PDF Template, Draft instructions for qbi provide new tracking worksheet (irc §199a) draft instructions for form 8995, qualified business income deduction simplified. In 2024, the limits rise to $191,950 for single filers and $383,900 for joint filers.

IRS Form 8995 Simplified Qualified Business Deduction, We are not a trade or business. we are a married couple who own vanguard 500 index, growth index, and primecap. However, you can deduct up to 20% of the qualified business income.

IRS Form 8995 Simplified Qualified Business Deduction, This article walks you through how to use irs form 8995 to determine: Draft instructions for qbi provide new tracking worksheet (irc §199a) draft instructions for form 8995, qualified business income deduction simplified.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF, Form 8868, application for extension of time to file an exempt. Draft instructions for qbi provide new tracking worksheet (irc §199a) draft instructions for form 8995, qualified business income deduction simplified.

Tax Form 8995 ⮚ 2022 IRS 8995 Form PDF Printable & Instructions to Fill, By completing irs tax form 8995, eligible small business owners can claim the. What is irs form 8995?